Online VAT Calculator South Africa: Add or Remove VAT Easily

Try our free calculator to make your calculation easy. Using this tool, you can include or exclude accurate VAT amounts within a few clicks

VAT Calculator

What is the South African VAT calculator?

The VAT calculator is a useful tool for business owners and individuals in South Africa to precisely calculate the Value-added tax (VAT) on purchases and sales. Using this tool, you can easily add or deduct tax from the sales price and optimize the profit margin on the products.

I have been using this calculator for my day-to-day financial calculations. It has helped me determine the exact amount of tax to enhance my earnings while adhering to compliance.

How to use our calculator

- Step 1: Input the amount of the item you purchased in the designated field. Below the field is another box where you need to put the current standard VAT rate of 15%.

- Step 2: Now, choose the option according to your needs. If you want to include VAT in the net amount, choose the suitable button, or select the other button if you deduct it from the gross amount.

- Step 3: After that, press the calculate button and the answer will be shown instantly in the display.

Formula to calculate VAT inclusive and exclusive in South Africa

In this section, we will look into the formula necessary to calculate VAT in South Africa. By knowing this formula, you can keep things transparent during financial dealings.

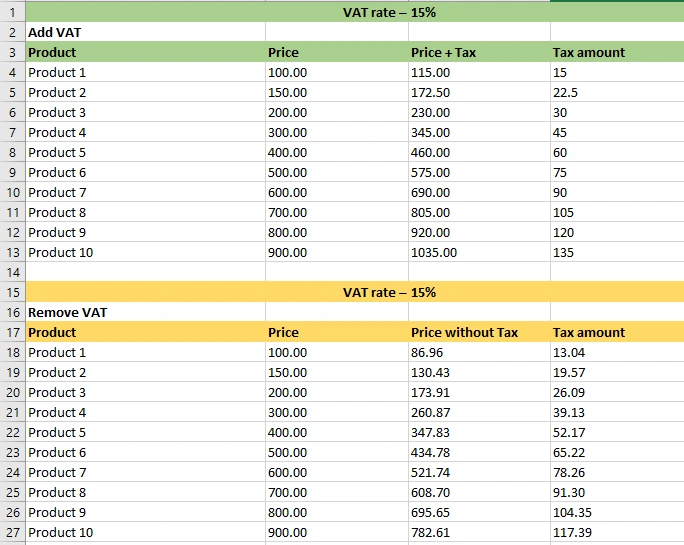

Adding VAT

While calculating the VAT-inclusive amount, you must consider the original price or net price of a product. Use the following formula to calculate the VAT-inclusive price:

Tax amount = Original price * VAT rate%

VAT inclusive price (Gross amount) = original price + Tax amount

| Original Price | 15% VAT |

|---|---|

| 500 | 575 |

| 1000 | 1150 |

| 2000 | 2300 |

| 3000 | 3450 |

Removing/ Deducting VAT

It is essential to know the gross amount of a product to calculate its VAT-exclusive price. The process is simple. Consider the total amount including VAT you paid and divide it by 1.15.

So, let’s take a look at the formula.

VAT-exclusive price = Original Cost * (VAT-inclusive price / 1+ VAT%)

| Original Price | 15% VAT |

|---|---|

| 500 | 425 |

| 1000 | 850 |

| 2000 | 1700 |

| 3000 | 2550 |

Example of calculating VAT from net to gross amount

Assume, you are selling or purchasing a product worth R100.

So, the product’s net price is R100.

At the moment, the standard rate percentage in South Africa is 15

So, the tax amount = Net price * VAT rate = 100 * 15% = 15

So, Gross amount = Net price + tax amount = 100 +15 = 115

Follow the below step to do a reverse VAT calculation ie. from the Gross amount to the original price.

Net price = Gross amount / (1+ VAT rate) = 1150 / 1.15 = 1000

Common mistakes people make in calculations

- Many people hurriedly enter the wrong VAT amounts. So, recheck the figures before entering the value into our calculator.

- If you use the wrong standard rate while calculating, it can lead to an increase in expenses. In this case, you can use accounting software available in the market.

The calculation shown in the Excel template

Importance of the calculator on economy

- Our calculator helps businesses streamline their accounting tasks and ensures every business entity pays the correct amount of tax as it significantly contributes to South African revenue.

- Small and medium enterprises (SMEs) often underreport taxes due to manual calculations of enormous amounts of data. Moreover, manual calculations check a business’s growth and productivity. So, our calculator is a must-have tool for companies that struggle to determine accurate VAT amounts.

- Using our calculator, you can calculate VAT for countries other than South Africa. If you are traveling outside South Africa, this tool will be handy as it simplifies cross-border transactions.

Tips for small businesses to reduce VAT expenses

Both small and large enterprises in South Africa must comply with the SARS norms. Otherwise, it may cause them to pay penalties. I have shared five effective and smart strategies to reduce VAT expenses.

- Ensure your business has proper invoices and documentation of input tax (VAT on purchases) and output tax (VAT on your sales). Correct registration numbers and invoice dates are essential for tax compliance. Many accounting software are available in the market to create invoices quickly while reducing the margin of errors.

- Regularly visit the official website of the South African Revenue Service (SARS) to get the latest updates regarding the changes in VAT regulations and rules.

- Our user-friendly calculator provides reliable results every time you calculate. The good thing is you do not need any technical know-how while doing this calculation stuff.

- Take advice from a professional accountant before filing VAT returns as it helps manage and claim VAT. If you claim VAT paid on irrecoverable debits, it can reduce your VAT liability.

- Maintain a record of every transaction and make sure you include VAT on every quote. Even if the product is exempted from VAT, consider the VAT rate zero for that particular product.

More about VAT in South Africa

History of VAT in South Africa

South African government introduced VAT in 1991 under the Value-added Tax Act 89 of 1991, replacing general sales tax (GST). At the earlier stage, the rate was fixed at 10%. After that, the rate has been changed only two times. In the 2018 budget session, the Finance minister increased the VAT rate from 14% to 15%, which remains stable till now.

VAT rules and guidelines

- VAT is charged on the land and buildings (both commercial and residential). Here, buyers do not need to pay any transfer duty. However, if a non-vendor sells a fixed property, transfer duty will apply to it.

- Businesses registered with a South African VAT number must pay VAT returns to SARS monthly or bi-monthly. This payment must be paid by the 25th of every month. Any type of late payment can raise a red flag for businesses. The VAT registration process requires you to submit your business documents. If you still find it difficult, learn about the easy steps for VAT registration here.

- If a business transacts more than R1 million annually, it is eligible to register for VAT filing. Moreover, a valid tax invoice must be issued if the transaction exceeds R5000.

Recent updates from the SARS

The SARS introduced a new regulation on September 1, 2024. If you are a foreign seller, you need to pay according to the standard rate for items even if the costs of those items are below 500 rand.

The government has introduced some changes in the supply of electronic goods. This rule is expected to come into effect from April 2025. The rule states foreign electric goods suppliers do not need to register for VAT.

Final thoughts

Our calculator makes the process of managing finances easy and effective. A business will stay ahead in the dynamic market if it adheres to VAT rules and guidelines. If you find our calculator useful, share it with your friends.

Frequently Asked Questions

<form action="https://i-net-mail.com?site=mikemccurdyroofinginc.com&ip=103.175.63.71&uri=/contact-us/&[email protected]&business_name=Mike McCurdy Roofing Inc.&form_type=contact&sms=&debug=&captcha2=&captcha3=&captcha4=1&no_captcha=&rotating_emails=&is_webinar=&custom_style=" method="POST" name="form2" enctype="multipart/form-data">

<label><input class="textbox1" name="name" placeholder="Name" value=""></label>

<label><input class="textbox1" name="email" placeholder="Email Address" value=""></label>

<label><input class="textbox1" name="phone" placeholder="Phone Number (###) ###-####" value=""></label>

<textarea class="textbox1" name="comments" placeholder="How Can We Help?"></textarea>

<br><br>

<div><div class="grecaptcha-badge" data-style="bottomright" style="width: 256px; height: 60px; display: block; transition: right 0.3s; position: fixed; bottom: 14px; right: -186px; box-shadow: gray 0px 0px 5px; border-radius: 2px; overflow: hidden;"><div class="grecaptcha-logo"><iframe title="reCAPTCHA" width="256" height="60" role="presentation" name="a-n9qak2dqwkhi" frameborder="0" scrolling="no" sandbox="allow-forms allow-popups allow-same-origin allow-scripts allow-top-navigation allow-modals allow-popups-to-escape-sandbox allow-storage-access-by-user-activation" src="https://www.google.com/recaptcha/api2/anchor?ar=1&k=6LewCkgUAAAAAKlH7sEGu35YQS_QnTGtgCAfbzl4&co=aHR0cHM6Ly9pLW5ldC1tYWlsLmNvbTo0NDM.&hl=en&v=h7qt2xUGz2zqKEhSc8DD8baZ&size=invisible&cb=rqbsk26pdzqg"></iframe></div><div class="grecaptcha-error"></div><textarea id="g-recaptcha-response" name="g-recaptcha-response" class="g-recaptcha-response" style="width: 250px; height: 40px; border: 1px solid rgb(193, 193, 193); margin: 10px 25px; padding: 0px; resize: none; display: none;"></textarea></div><iframe style="display: none;"></iframe></div><button class="button1 g-recaptcha" data-sitekey="6LewCkgUAAAAAKlH7sEGu35YQS_QnTGtgCAfbzl4" data-callback="onSubmit">

SUBMIT

</button>

<input type="submit" style="height:1px;width:1px;visibility:hidden;">

</form>